Up until very recently, first time buyers in the UK were experiencing extreme difficulties when trying to gain access to the property ladder. Without huge deposits and the will to spend their entire wages on a mortgage they probably couldn’t really afford, many thousands of individuals and couples thought they’d never manage to own a home outright.

Over the last few months, the British government has announced a new scheme to help those people achieve property ownership by 2014. The “help to buy” scheme as it’s become known is proving to be a great success amongst young people and first-timers, which is why it’s somewhat of a shame to hear that the Bank of England has some serious problems with it’s implementation and the effects it could cause.

Still, a lot of people haven’t heard much about the opportunity, and they’re a little confused as to how it all works and how it could benefit them. With that in mind, I’ve decided to write this article to explain the ins and outs in layman’s terms - I’ll also attempt to relay why the Bank of England is taking such an issue with it.

The Lowdown On Help To Buy

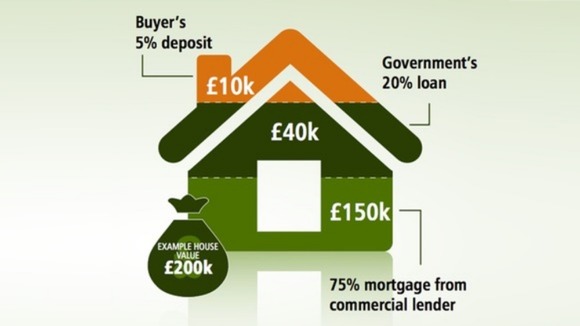

Help to buy is primarily a government-backed loan system that aims to give first-time buyers and those purchasing a new build some extra financial support. Buyers are required to contribute 5% of the property price as a deposit (instead of the 10 - 15% usually expected), and the government is willing to lend them up to 20% of the value, meaning they only have to get a mortgage for the remaining 75%. More details can be found at The Little House Company

This should be music to buyers ears. No interest is charged for the first 5 years, but from the 6th year you’ll be expected to pay a minimal interest fee of 1.75% - almost nothing. The only drawback is that the loan must be paid back if you decide to sell the property, but considering how slowly prices tend to rise in the UK, this will hopefully encourage owners to stay within their homes for longer periods.

The Bank of England’s Problem

They seem to take issue with everything these days, don’t they? Even so, In truth, they have a truly valid argument. The people who run the Bank of England are worried that the new scheme will create an increase in demand that our property supply cannot handle. This would obviously cause prices to rise and leave many of the buyers who would have benefited from the scheme in a worse position.

Also, they’ve highlighted concerns that the help to buy scheme will become a permanent feature in our economy if this happens. At the moment, most people are having trouble affording a good enough mortgage to buy their first property, but if the scheme encourages a stark rise in prices, it will be impossible for most residents to buy a home without it.

You can probably see their point, right? However, regardless of which side of the fence you sit, you have to admit that this scheme is a double-edged sword, and nobody can predict its long term impact, and this is why many believe it needs to be completely reconsidered.

Author Nick Marr

Are you looking to buy property in UK ? Hurghada , Scotland , Istanbul , Sahl Hasheesh , Dubai

Are you looking to rent property in UK ? London , Manchester , Reading , Leeds , Cardiff

Author

Carol McDonald