Being a landlord can be financially rewarding, however, it isn’t just a case of sitting back and reaping the benefits once a month. No, there is plenty of mental and physical work that goes into managing a buy-to-let property. There are lots of challenges that landlords face as they maneuver the rental world. But there is also a lot of help out there! Understand and being aware of the most common problems faced by landlords is important to ensuring that you are fully prepared for the highs and lows of the rental marketplace.

Here are four of the most common problems faced by landlords.

Tenant’s making late payments or missing them altogether is an all-too-familiar problem for landlords. As one of the most common problems that landlords face you can be assured that if it hasn’t already, it will happen to you at some point too. There is some consolidation in the fact that you’re not alone, others have been through a similar thing. Because of this, there is plenty of help out there to ensure that you get your tenants rental payment as soon as possible or get the tenant out.

It is important to distinguish whether this is a late rental payment or a missed rental payment. There is a very distinct difference and the answer will decipher how you subsequently deal with the situation.

Late rental payments can often be solved through simple communication. A late payment may be the result of a busy tenant or a difficult situation, but most importantly it might just be temporary and communicating with your tenant may shed some light on the situation and subsequently encourage payment.

A missed payment, however, may be the beginning of an eviction process and consequently needs to be taken more seriously. If the tenant falls into 2 months of arrears then the eviction process can begin.

Find out more: How to Evict a Tenant Quickly

How can I avoid this?

There are numerous ways to ensure that your tenants pay rent each and every month, including rent collection services that insure your rental income.

RentScore Plus is a service that both collects your rental income and offers Rent Protection Insurance. They handle all aspects of rent collection so you can simple enjoy the financial benefits! Tenants are encouraged to pay their rent on time as each payment is registered with Experian and subsequently appears on their credit report. Late or missed payments will subsequently negatively impact the tenant. On top of this, the first class Rent Protection Insurance ensures that, regardless of whether your tenant pays or not, you will still receive your rent.

Never be out of pocket again with RentScore Plus.

#2 Legal Compliance

With over 145 individual laws and more than 400 regulations to follow, it isn’t surprising that 1 in 5 landlords claim to find it ‘impossible’ to keep up with constant regulation changes. The results evidently prove that landlords are overwhelmed by the sheer volume and complexity of rules and regulations in the rental market. Being fully versed in the legal aspects of being a landlord is not only complicated, but also very time-consuming.

Doing your homework and keeping on-top of landlord legalities is a good idea for all landlords, but with such a high amount and lack of stability, it is difficult for the best of landlords to keep up.

How can I make sure I am fully compliant?

Luckily there are thousands of guides on the internet to help you feel confident in your law-abiding investment. However, despite the plethora of information available on the internet, it can be daunting and more often than not, not relevant to your specific situation. This is why TheHouseShop’s FREE landlord advice helpline number is a must-have! Their FREE service offers specialist advice on anything from tenant disputes to evictions, ensuring that you are fully compliant and aware of your rights.

Give them a call on 0800 368 7554 Mon-Fri, 9am-5:30pm.

Or, from as little as £59.99 you can purchase TheHouseShop’s property management service and feel confident as a landlord as they make their priority to ensure that you are fully compliant with your legal obligations.

#3 Property Damage

Wear and tear is a common and accepted form of damage to a property, however, a punched hole in the wall, a smashed window and a ripped sofa is hardly going to pass as ‘wear and tear’. A damaged property is more than just proving that the tenant did it, it includes the landlord finding a vendor to fix the issue, paying for the issue and ensuring that it doesn’t happen again.

Inventories can be a lifesaver when it comes to property damage, as they can be used to prove whether or not the damage was present before or after the tenant began their tenancy and therefore if the tenant is responsible.

Once the blame finger has been suitably pointed, you will need to start the process of fixing the damage. Deciding who is responsible is key for figuring out where the repair money will come from; a deposit, a claims court, or your own pocket…

How can I avoid this?

There isn’t a set way to avoid property damage, but there are ways to reduce the possibility. Obtaining good and trustworthy tenants is highly recommended for maintaining a well-kept property. Going through the appropriate screening and tenant checks is crucial to ensure that your new tenants are going to take care of the property and create minimal damage.

Tenant Referencing Checks from as a little as £9.99!

#4 Sub-Letting

Many tenants sublet, with or without the knowledge or consent of their landlord.

Some landlords think that in the case of sub-letting, ignorance is bliss. Dealing with extra tenants is a hassle and as long as you are getting your rent on time each month, what is there to worry about?

Well, actually, there is a lot to worry about. Many mortgage lenders do NOT accept subletting and to do so would void your policy and give them the right to withdraw the loan. So, many landlords should be paying attention…

Furthermore, many buy-to-let insurance companies also do NOT cover sub-letting and, once again, to do so would breach the contract.

How to avoid this.

Again, there isn’t a set way to avoid sub-letting apart from making it very clear and concise in the tenancy agreement that this is forbidden during the tenancy. A sub-letter would, therefore, be a breach of contract.

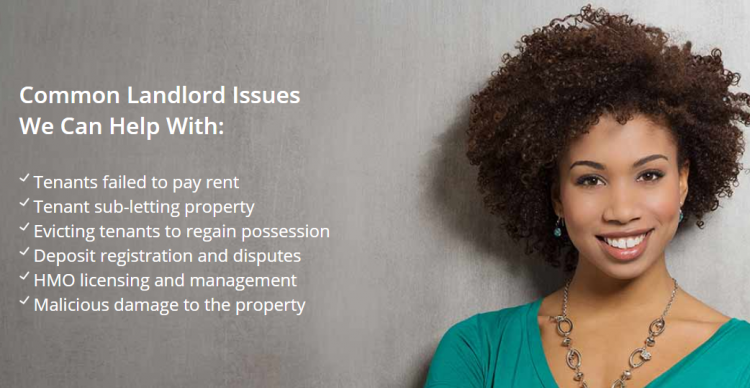

Need some extra help?

All of the above problems are common for landlords but they are also mostly unavoidable and disaster can be easily averted. However, if you find yourself unsure on how to deal with any of the above then you can always give TheHouseShop a call! Their FREE landlord advice helpline is there to help you with any queries you may have in regards to your buy-to-let property.

Give them a call on 0800 368 7554 Mon-Fri, 9am- 5:30pm