Buying property is an expensive undertaking, and even more so since the Stamp Duty Land Tax (SDLT) surcharge was introduced in 2016. First announced in the Chancellor’s 2015 Autumn Statement, the extra 3% tax applies to anyone purchasing additional residential properties worth more than £40K such as a holiday home or a buy-to-let property in the UK. Mobile homes, houseboats and caravans are exempt. Here’s how it works.

Since 2014 when the law on SDLT was updated, stamp duty is calculated as a tiered tax. A bit like income tax, you only pay the higher rate on the amount above any threshold. However, if you buy a second property, the 3% surcharge is charged as a slab tax, meaning it applies to the total purchase price of your house or flat. See this table:

Take a buy-to-let property costing £300K, for example. Regular stamp duty will amount to £5K but add to that the SDLT surcharge of 3% on the entire price (£9K) and the total amount payable is £14K.

Let’s take a look at various property purchase scenarios to see how the SDLT surcharge would apply.

Replacing your main residence

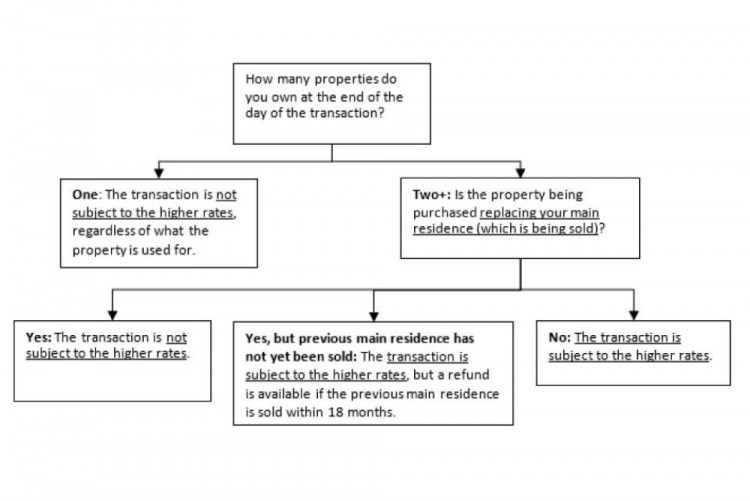

If you’re replacing your main residence by selling one property and buying another, you won’t have to pay the 3% surcharge, even if you own additional properties. Here’s an illustration taken from the government website:

“A owns both a main residence and a second home. She sells her main residence and purchases a new one. Although she has two properties at the end of the day of the transaction, she has replaced her main residence so the higher rates will not apply.”

It gets a little more complicated if the transaction is not simultaneous. What happens if you need to buy your new main residence before you can sell the old one? Or if you sell your main residence but cannot buy a new one straightaway? Here’s an official attempt at clarification:

In the first case, you sell your main residence but don’t immediately buy a new one, choosing to move into rented accommodation in the interim, for instance. As long as you buy a new main residence within 36 months of completing the sale of your old home, the surcharge won’t have to be paid.

In the second scenario, you purchase a new main residence and don’t immediately sell the old one. The 3% SDLT surcharge will be payable initially, but as long as you dispose of the old property within 36 months within completing the purchase of your new home, HMRC will refund in full.

Buying a property together

It doesn’t matter whether you’re buying with your partner, your child or a friend, if there are two names on the title deed, they will both be taken into account. If one or both of you already own property, buying jointly will trigger the surcharge.

If, on the other hand, you bought the property, say, for your child outright and only their name appeared on the deeds, the 3% surcharge would not apply. The same goes for a property purchase with a partner who doesn’t already own. The surcharge will apply unless only their names goes on the deeds.

Owning property abroad

If you already own or part-own a property, whether it is located in the UK or abroad, you’re liable to pay the surcharge if you decide to buy an additional property in the UK. So if you have a family holiday cottage in the South of France and want to buy a house back home, you will have to pay 3% extra tax.

On the other hand, if you’re a UK property owner and are thinking of buying a holiday home abroad, your investment purchase won’t fall under UK tax legislation. It will be the tax regime of the country you’re buying in that will apply.

Professional landlords

The government initially envisaged that companies and individuals owning 15+ residential properties (or making bulk purchases of 15+ properties) would be exempt from the 3% surcharge. However, this has not been confirmed. As stated in the 2016 Budget, larger landlords are subject to the same additional taxes as anyone else.

Inherited properties

If you acquire a property by way of inheritance, regardless of whether you are already a property owner, there is no stamp duty payable. That said, if you went on to purchase another home without selling the inherited property, you would be hit with the surcharge.

Are you looking to buy property in UK ? Hurghada , Scotland , Istanbul , Sahl Hasheesh , Dubai

Are you looking to rent property in UK ? London , Manchester , Reading , Leeds , Cardiff

Author

Homesgofast com

Homesgofast.com is an international real estate portal and news source for Google news. Publishing international real estate, finance, homes and travel-related news and blogs for a targeted audience since 2002. Each news item is circulated to thousands of potential readers each day and is also available to the millions of people who sign up for Google news alerts. Find homes offered for sale and to rent direct from owners and some of the best real estate agents from over 35 countries