According to housing charity Shelter, nearly two million 20-34 year olds are stilling living at home with their parents. This “Peter Pan generation” are unable to afford to put down a deposit on their own home, and even more worryingly, many of them are unable to afford to rent a property.

Parents of many young people are having to lend them money for a housing deposit and this has totalled an amount of £2billion. Many young people are also having to move back with their parents in order to be able to save up enough themselves. For those looking to put down a deposit on a house, it can be worth looking into how much you would need, and how long you would need to save for.

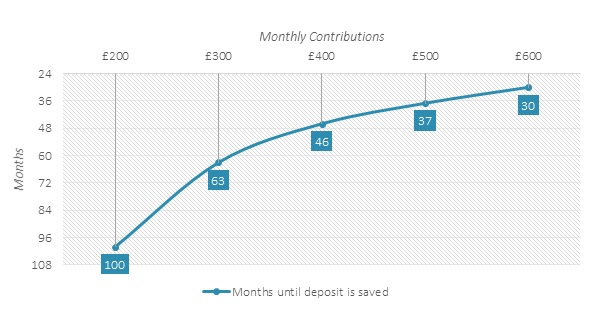

Totally Money’s affordability tool calculates how much you need to save per month, and for how long, in order for you to be able to afford a deposit. If you wanted to live in Birmingham and could save £500 per month, you would be able to afford the deposit for a house in just over three years. This is based on the average house price in Birmingham which is £117,923 and the assumed deposit of 15%.

How long will it take me to buy in Birmingham?

Further north in Blackpool, if you saved the same amount each month (£500) you would have enough for a deposit in two years as the average house price here is £82,630.

Owning a home has become an increasingly distant dream for the majority of Britain's youth. In fact, housing charity Shelter have recently stated that as many as nine million people are presently renting in the private sector. This could affect many people as they most likely won’t be able to save and pay for their rent.

There are many options out there which could help someone in this situation. Downsizing is a massive option if you have no other choice but to rent; weighing up if you really need extra bedrooms or a parking space can have a massive impact on your savings as well as if you can move closer to work to cut down on commuting costs.

As usual, the best way to counter this problem is with knowledge. By getting the best information out there in order to determine what you are able to afford, you can plan accordingly. Aside from Totally Money's tool, you can look at mortgage calculators such as this one from Money Saving Expert.

Photo: Slack12

Are you looking to buy property in UK ? Hurghada , Scotland , Istanbul , Sahl Hasheesh , Dubai

Are you looking to rent property in UK ? London , Manchester , Reading , Leeds , Cardiff

Author

Carol McDonald